There are many fabulous charities in this area – all making a difference to people’s lives in a wide variety of fields.

We act for several of them, including the local branch of the Riding for the Disabled Association (RDA), which is why we had the privilege of taking part in the official opening of the organisation’s new centre by HRH The Princess Royal at Reaseheath College earlier this year.

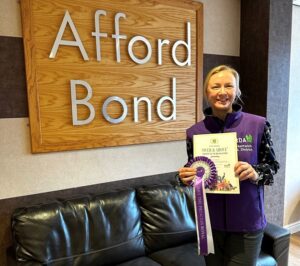

As part of the opening ceremony, Associate Director at our Nantwich office Jen Johnson, who is both a Trustee and Treasurer for the local RDA, was presented with a certificate by HRH for going ‘Over & Above’ to support the cause. This was specifically for her leading role on budget control, particularly in handling the huge increase in work required to successfully complete the building project.

Jen explains: ’The charity was lucky enough to have been gifted some money which meant they were able to build several brand-new stables, a meeting room and office as well as installing a riding simulator and hoist to help people familiarise themselves with some of the aspects of riding before moving on to the real horses.

A royal pat for the ponies!

‘It was such a privilege to be part of this project, and to receive the award. The Princess was very engaged and chatting with everyone on the day, including all the riders – and quite a few of the ponies got a pat too!

‘The Princess has been the charity’s Patron for a long time and has supported many events over the years – which is greatly appreciated. All the RDA’s running costs are met by fundraising, donations and legacies and everyone involved is a volunteer: they do a fantastic job enabling disabled children and adults to build their confidence and have great fun with activities like riding and carriage driving. They provide therapy, fitness, skills development and opportunities for achievement – it’s a wonderful organisation that operates at over 400 RDA centres all over the UK.’

The RDA locally uses our full accountancy and audit service, which we can provide to any charity or not-for-profit organisation in the same way that we work for PLCs, Limited Companies and Partnerships etc.

We can also offer charities a basic ‘Independent Examination’ service which is essentially professional oversight and checking of accounts that they prepare themselves if their affairs are not too complex.

Restricted and Unrestricted Funds, Grants and VAT

There are some special considerations when dealing with these sorts of organisations – for example, there can be ‘restricted’ funds where donations and/or grants have been secured for a specific project so these monies can only be spent in that area. ‘Unrestricted’ funds on the other hand can be used more generally for running/operational costs – whatever the organisation might need.

There are usually a number of potential income sources for charities so, as well as donations, there will be grants available from Trusts, local government and national government agencies and from sources such as the National Lottery – and we can help draft the grant applications.

Most people think charities and not-for-profit organisations are exempt from VAT and while this is generally true, it doesn’t apply to all activities – if they run a tearoom as part of their fundraising for example.

Gift Aid: tax breaks for donations

And of course, donating money to charities can be a double benefit – not only providing much needed funds for good causes, but also offering the donor a tax break.

If you are a higher rate taxpayer, in any year a donation is made, your basic rate band will be extended by the amount of the donation. This means you will pay more tax at 20% and less tax at 40% or 45% – and there is no limit to the value of your donation. A limited company can also get a similar ‘offset’ tax break against Corporation Tax for charitable donations.

As with all tax matters, getting the right advice is key. So, if you’re working in a local charity or not-for-profit organisation – or you’re a higher rate taxpayer who would like to contribute to one – why not get in touch with our expert Jen Johnson for a ‘no obligation’ chat.

Email her at Jen.Johnson@affordbond.com